Effective January 2013, California’s AB 32 Cap-and-Trade program was the first market-based regulatory system adopted in the United States for the control of Greenhouse Gas (GHG) emissions. Over the past 12 years, the AB 32 Cap-and-Trade program has regulated GHG emission sources emitting greater than 25,000 metric tons of CO2e per year, which consist primarily of industrial facilities, utilities and transportation fuel suppliers. Recently on September 19, 2025, the State of California enacted new legislation (AB 1207 and SB 840) that formally extended this Cap-and-Trade program through Calendar Year 2045 and proposed other regulatory changes. These legislative actions are consistent with the 2022 Climate Change Scoping Plan (2022 Scoping Plan) as published by the California Air Resource Board (CARB) in December 2022. In this 2022 Scoping Plan, CARB proposed several regulatory and policy objectives relating to climate change, which included the agency’s plan to extend the AB 32 program and other key proposals. AB 1207 and SB 840 are important legislative actions that largely reflect CARB’s climate change objectives for the next twenty (20) years within the State of California, which key elements are summarized as follows.

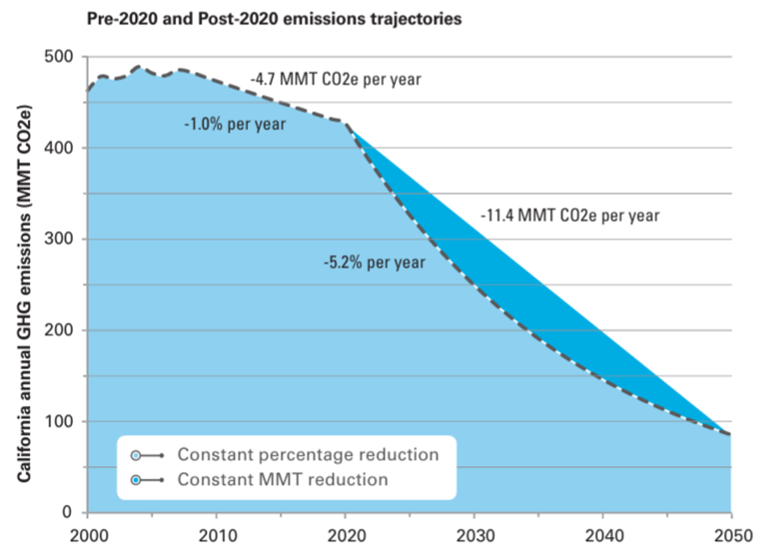

Consistent with the 2022 Scoping Plan, AB 1207 did not change California’s climate change goal to eliminate 85% of anthropogenic GHG emissions by 2045. However, among its provisions, AB 1207 did formally rebranded the AB 32 Cap-and-Trade program to the “Cap-and-Invest” program, which the annual budget allowance or “annual cap” is a key component to achieving these GHG goals. Under current regulations, the AB 32 program’s “annual cap” is required to automatically decline each year, which provides a majority of expected GHG reductions through 2045 (see below).

Source: CARB, 2013 Scoping Plan, May 2014

AB 1207 also changes the California Carbon Offset (CCO) limits from the current 4% of annual compliance obligations (2021-2025) to 6% from 2026 through 2045, provided there is a maximum of 50% from offset projects that originate from outside California. While providing some additional flexibility for annual compliance through CCOs, this change also recognizes a future where the supply of California Carbon Allowances (CCAs) will become increasingly scarce in order for California to achieve its climate change objectives. As an example, another key regulatory change is a requirement that CCOs used for compliance will require retirement of an equivalent number of available CCAs from the following year’s “annual cap”. This mandatory retirement of additional allowances will further reduce “annual caps”, which lowers the supply of available CCAs in future years. Unless the demand for CCAs is reduced by equivalent amount, this regulatory change will place additional upward pressure on the price of future CCAs, which are purchased and used by AB 32 facilities for annual compliance. Note that AB 1207 also directs CARB to further evaluate price containment provisions for CCAs and consider adjustments to the price ceiling for consumer protection in case of future runaway prices, which these protections will be determined based on future CARB rulemaking.

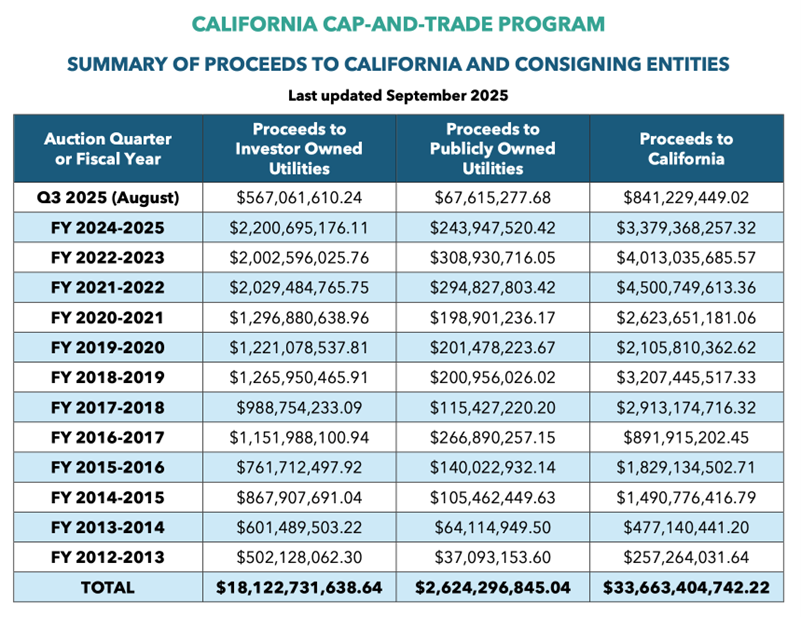

While the exact reasons for rebranding the Cap-and-Invest program is not clear, one possible explanation is the growing importance of the AB 32 program as a revenue source for the State of California. Established in 2012, the Greenhouse Gas Reduction Fund (GGRF) was created as part of the AB 32 Cap-and-Invest program. Under existing law, California’s share of proceeds from AB 32 quarterly auctions of CCAs are deposited into the GGRF, which these funds are intended for projects (or investments) that reduce GHG emissions within the state. As shown below, since the adoption of AB 32, total revenues from the AB 32 quarterly auctions have exceeded approximately $54 billion, of which the State of California’s share exceeded $33 billion. The remaining $21 billion from quarterly auction revenues are divided between investor-owned and publicly owned utilities, which is required under existing state law. In general, the annual revenues from CCA auction sales have steadily increased since 2013, which California’s share of annual proceeds have averaged approximately $4 billion over the past 3 compliance years.

Source: CARB, Cap-and-Trade Program, Summary of Auction Proceeds, September 2025

Due to various factors, annual proceeds from AB 32 quarterly auction sales are expected to continue growing in future years. One primary factor is that current regulations require the floor price (or minimum price) of CCAs sold at quarterly auctions to be increased annually by 5% plus inflation. In addition, due to declining AB 32 “annual caps”, the CCA supply is also expected to transition into deficit within the next few years such that market demand will exceed available supply. As noted above, future CARB rulemaking could also exacerbate these CCA supply deficits if the “annual cap” is further reduced due to mandatory retirement of carbon offsets in future compliance years.

To extend the state’s authorization for use of these future CCA annual proceeds, SB 840 focuses primarily on changes to the GGRF, including how AB 32 auction proceeds are allocated under a new spending framework. Starting in fiscal year 2026-27, spending from the GGRF (i.e., “investments”) will be directed across various statewide climate change categories and projects, such as clean transportation, housing and community investments, clean air and water, wildfire prevention and resilience, agriculture, clean energy, and climate focused innovation. While GGRF proceeds are intended for projects that help achieve California’s climate change goals, the amount of GHG emission reductions that are actually achieved from these various investments are yet to be determined.

A prime example of a “Cap-and-Invest” expenditure is California’s controversial high speed rail project. Funded in 2008 by California taxpayers through a statewide bond measure for $9.95 billion plus additional $3.5 billion in federal grants, California’s high-speed rail project involves a 494-mile rail system connecting San Franciso and Los Angeles. While originally proposed to be completed by Calendar Year 2020, less than 25% of the high-speed rail system is currently under construction due to cost overruns and other delays. With construction expected to continue through at least Calendar Year 2039 and no clear completion date, project costs have now risen to exceed $100 billion based on current estimates. California’s high-speed rail project is expected to receive an additional $1 billion per year from the GGRF as a result of this legislation to extend AB 32 through Calendar Year 2045.

The Future of California’s Cap-and-Invest Program

Since 2013, CARB’s regulatory approach under AB 32 has largely focused on implementing regulatory programs targeted at industrial sources, transportation fuels and utilities, of which the Cap-and-Invest program has been a key regulatory component. Other AB 32 programs targeting anthropogenic GHG emissions have included Low Carbon Fuel Standard (LCFS), Zero Emission Vehicles (ZEVs), Renewable Portfolio Standard (RPS) and others. However, in its 2022 Scoping Plan, CARB made carbon neutrality a primary driver to achieving California’s climate change goals through Calendar Year 2045. In order to attain carbon neutrality, CARB is anticipated to adopt increasingly aggressive regulatory measures that may include zero carbon fuels, Carbon Capture and Sequestration (CCS) and others. As a consequence, AB 32 facilities can expect a future with additional AB 32 regulation, shrinking supplies of available CCAs and greater compliance costs, especially for high-emitting industries. Based on the recent passage of AB 1207 and SB 840, it is clear that Cap-and-Invest program will continue to play an important role over the next 20 years as a key regulatory driver for affected industries, as well as a principal revenue source for California to achieve its climate change objectives by 2045.

Trinity Services

Trinity can help industries comply with California’s AB 32 Cap-and-Invest program by providing comprehensive regulatory and technical support, including:

- Regulatory Tracking & Interpretation

- Emissions & Allowance Strategy

- Data Management & Verification Readiness

- Stakeholder Engagement Support

- GHG Reduction & Offset Opportunities

- Strategic & ESG Integration

For more information on the AB 32 Cap-and-Invest program or Trinity’s sustainability consulting services, please reach out to Steve Walters or Charles Lee from the Trinity Irvine Office at 949.567.9880.